Think you know all your military tax breaks? Last year, service members left an average of $4,200 in tax savings unclaimed. Here’s your battle plan to keep more of your money this year.

Combat Zone Tax Exclusion Gold Mine

Most service members know combat pay is tax-free, but here’s what your tax preparer won’t tell you: Every dollar earned in a combat zone – including bonuses, special pays, and awards – becomes tax-free gold.

One Marine Sergeant timed his $32,000 reenlistment bonus with his deployment, saving $7,040 in taxes instantly. He also maxed out his Roth TSP with tax-free income, creating a double tax advantage. His total tax savings during a 9-month deployment? $12,840. The real genius move? He stacked four different special pays during deployment, all tax-free. Combined with the strategic timing of his promotion, he sheltered $82,000 from taxes in one tour. By investing these savings in his TSP, he turned one deployment’s tax benefits into $48,000 over just five years.

Moving Expense Magic

While civilians lost their moving deduction in 2018, military members kept this golden ticket. PCS moves to unlock massive tax savings most miss. That last-minute U-Haul rental? Deductible. Extra baggage fees? Write them off.

One Army family documented every expense during their Fort Bragg to Fort Hood move. Beyond what the military covered, they claimed $3,200 in extra expenses – saving $704 in taxes. But they didn’t stop there. They deducted house-hunting trip costs, temporary storage fees, and even pet transportation expenses. Their total deductible moving expenses hit $7,800, generating $1,716 in tax savings. Pro tip: They created a digital folder of receipts using their phone, making tax time a breeze. Even better? These deductions work for military spouses too when following active duty orders.

Tax-Free Housing Allowance Strategy

Your BAH isn’t just tax-free – it’s a wealth-building tool in disguise. Smart service members use their tax-free housing status to maximize mortgage interest deductions. An Air Force Major bought a home $50,000 above her BAH-supported price range. Why?

Her mortgage interest created $12,000 in itemized deductions while her tax-free BAH covered the payments. She structured her loan to maximize tax-deductible interest in the early years, knowing her BAH would increase with promotions. Total tax savings: $2,640 annually, while building equity in a larger home. The next-level play? She rents her basement to another service member, using their BAH to create taxable income that’s offset by depreciation deductions. Annual tax savings from this strategy? Another $3,200.

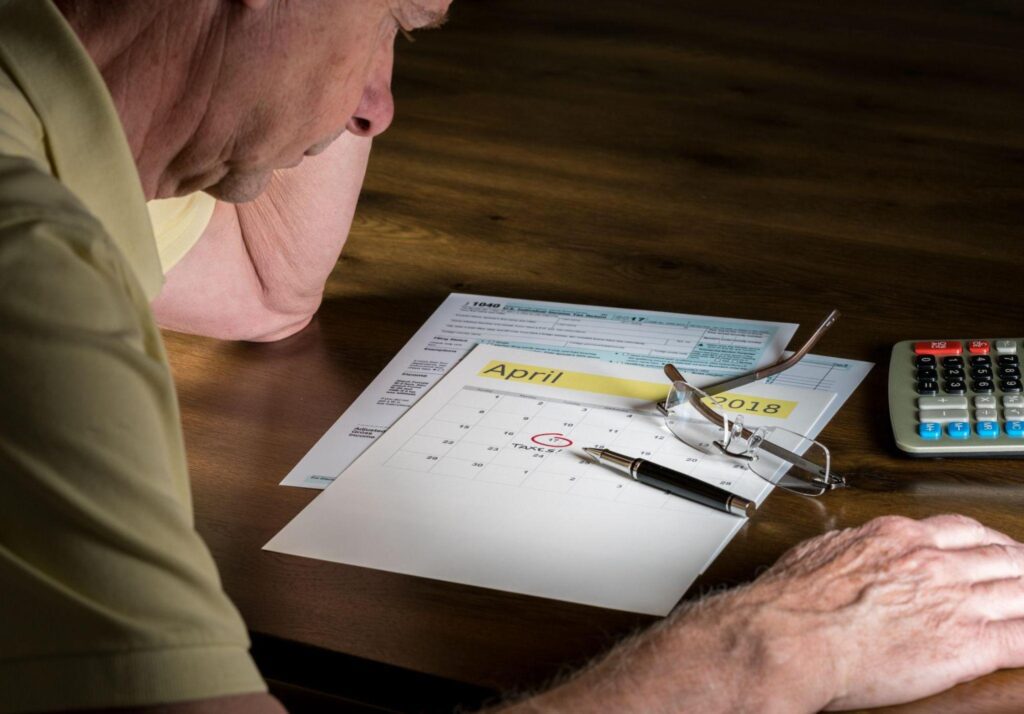

Military Retirement Tax Shield

Your military pension tax strategy needs to start before retirement. Here’s why: 31 states offer special tax breaks for military retirement pay, but the savings vary dramatically. One Navy Chief discovered a $12,000 annual difference between neighboring states.

By choosing Florida over Georgia for retirement, he saves $3,800 yearly in state taxes on his $48,000 pension. But the real magic happened when he structured his VA disability claim properly, making 40% of his retirement tax-free federally. He also times his Required Minimum Distributions from his TSP with his state’s special military retirement deductions. Total annual tax savings? $7,200. Even smarter: He uses his tax savings to fund a Roth IRA, creating a triple tax advantage in retirement.

VA Benefits Tax Protection

Every VA disability dollar arrives tax-free, but maximizing this benefit requires careful planning. A retired Marine worked with a Veterans Service Officer to convert $1,200 of taxable retirement pay to tax-free VA disability compensation through a post-retirement claim.

The VSO identified secondary conditions he’d missed, increasing his rating from 40% to 70%. New tax-free monthly income: $1,800. Annual tax savings: $4,752. Plus, his state exempts his remaining retirement pay from income tax. He also learned that his VA education benefits, housing grants, and even vehicle adaptation payments all dodge taxes. Total tax-free VA benefits annually: $32,400, saving him $7,128 in taxes.

State Tax Residence Power Play

Your military tax residence is like having a secret tax shelter. While civilians must pay taxes where they live, you can choose your tax home. Take that Texas driver’s license with you to high-tax California? Smart move.

One Navy family kept their Florida tax residence during a three-year San Diego tour, legally avoiding California’s 9.3% income tax. They proved their Florida residence with vehicle registration, voter registration, and return plans. Annual savings: $6,200. But here’s the genius part: They used California’s high cost of living allowance (tax-free) while paying zero state income tax. They invested the tax savings in index funds, building $22,000 in wealth during their tour.

Extension and Filing Benefits

Deployment tax extensions aren’t just about extra time – they’re strategic gold. Military members deployed during tax season get automatic extensions without penalties, plus 180 days after returning.

One deployed Air Force pilot used this to his advantage. Instead of rushing to file, he gathered documentation for every possible deduction during his extension. Result? He claimed $3,200 more in refunds than his rushed squadron mates who filed early. He also avoided $1,400 in penalties civilians would’ve paid. Smart move: He used the extra time to research state tax benefits for deployed service members, finding an additional $2,800 in state tax savings.

Special Pay Tax Breaks

Different special pays get different tax treatment, creating opportunities for strategic timing.

Flight pay? Taxable stateside, tax-free deployed. Hazardous duty pay? Same deal. One Navy aviator arranged her training schedule to complete high-paying schools during her deployment. Result? $18,000 in special pay, all tax-free. She also timed her aviation continuation bonus with deployment, saving $15,400 in taxes. The next-level move? She stacked submarine duty pay, flight pay, and foreign language proficiency pay all during a tax-free period. Total tax dodge: $33,400. By investing these tax savings, she’s building serious wealth.

Education Benefits Tax Shield

The GI Bill isn’t just free education – it’s a tax-free wealth-building tool. While civilian students pay taxes on scholarships exceeding tuition, your GI Bill housing allowance stays tax-free.

An Army veteran using the GI Bill saves $4,800 yearly in taxes on his housing allowance compared to taxable civilian scholarships. He also discovered his Yellow Ribbon benefits, tutorial assistance, and book stipends are all tax-free. Total tax-free education package: $38,000 annually. Smart strategy: He takes extra classes during high-BAH months, maximizing his tax-free income while accelerating his degree completion.

Death Benefits Tax Protection

Nobody likes discussing it, but understanding military death benefit tax advantages is crucial for family protection. SGLI’s $400,000 payout is tax-free, while civilian life insurance beneficiaries sometimes owe estate tax.

Death gratuity payments ($100,000) are also tax-free. One surviving spouse worked with a military-focused financial advisor to roll these tax-free benefits into a Roth IRA, creating lifetime tax-free growth. She also learned that Dependency and Indemnity Compensation (DIC) payments are tax-free. Smart planning kept $500,000 completely protected from taxes, generating tax-free income for life.

Your Tax-Saving Mission

Don’t let the IRS keep the money you’ve earned. Start with one benefit this week – maybe that state tax residence review. Then add another next month. Print this list, check each benefit, and get every dollar you deserve.